As a venture capitalist, I meet companies seeking funding every day with projected revenue vastly exceeding current revenue. How does a VC ascertain the likelihood of you achieving your forward revenue number? How do you demonstrate to a VC that you can credibly hit your projections?

What follows is a diagnostic framework that shows how a VC with an analytical bent will dissect your revenue projections to ascertain how realistic they are. This framework will be most relevant for companies with SaaS or recurring revenue models, particularly those that sell into the enterprise.

Let’s start with an example. Recently, I met an enterprise SaaS company with a useful product and a handful of blue chip customers with historical and projected revenue that looked something like this:

While this revenue ramp is certainly possible, it is rare.

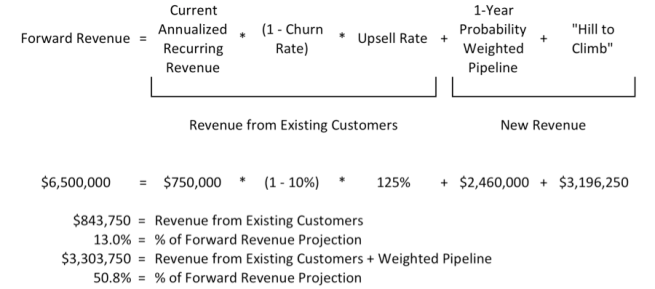

You can decompose your forward revenue number into two components, per the equation below. The first component is revenue that is “in the bag,” so to speak, based on your existing book of business. This component includes your exiting annualized recurring revenue (ARR, for a subscription business) and applies to it an assumption for churn and upsells. The second component is the new customer revenue you would need to add to this to meet your number. New customer revenue can be further broken down into your probability-weighted pipeline plus revenue from sources yet to be identified. My colleague Dick Harrington calls the yet to be identified bucket a company’s “Hill to Climb.”

In the example above, the exit ARR at the end of 2014 was $750,000. Let us assume that the ARR retention is 90%. Additionally, let us assume that we can expect upsells in the retained customer base (license revenue can be scaled by the sale of additional seats or new software modules) of 25%. At January 1, 2015, the company would have the following revenue quantum attributable to current customers:

$750,000 * (1 – 10%) * 125% = $843,750

This means that only 13% of the forward revenue will come from existing customers, a relatively low number. In a more mature SaaS business, we would look for a number closer to 70%. Having an existing customer contribution of 13% is not necessarily bad; it simply means that you have to grow very fast in order to hit your forward number. In order to achieve $6.5 million of revenue in 2015, just under $5.7 million of new sales need to be made. This is no small task for a business of this size; the company would need to find new revenue in an amount over 7x its existing run rate revenue. Is this achievable? Unlikely, but we would need to look at the pipeline to be sure.

The best way to convince an investor that your new sales number is achievable is to walk through your pipeline in a credible fashion. Often, especially seed stage companies show a pipeline that is not scrubbed and that includes every conceivable opportunity at every stage of engagement. I call this the “kitchen sink” approach.

The key to building investor credibility with your pipeline is to have a thorough understanding of your sales funnel. You need to understand how your sales cycle works and demonstrate knowledge of the likelihood of signing a customer at different stages of engagement. It is hard for seed stage companies to demonstrate this, but for companies with some revenue history, to the extent you can show your historical pipeline and how that has converted into revenue consistent with your probability weightings, that will build you a lot of credibility.

Next you need to enumerate all of your sales prospects in a spreadsheet and map them to the various stages of engagement and probability-weight them. In the example below, we have about $2.5 million of credible, probability-weighted pipeline.

The figure above shows that the existing new weighted pipeline (plus current customer revenue) only equates to about 50% of your forward revenue number. This is very low; investors typically look for gross pipeline coverage of 3-4x and weighted pipeline coverage of 1–1.2x forward revenue.

Plugging your revenue from existing customers plus your weighted pipeline into the formula above leaves a gap of about $3.2 million of revenue to come from currently unidentified sources. Is this “Hill to Climb” achievable? For an enterprise business, I would not bet on it.

It is important to think about this post in the context of the maturity of your company. It is very relevant for Series A (and later) stage companies, with a product/market fit and some revenue history. That said, I believe this is a useful thought exercise for seed stage companies as well. For enterprise SaaS companies seeking series A capital (and beyond), the analysis above will be a central focus of your VC.

I hope this simple framework is helpful to entrepreneurs as you think about your projections. If, after factoring in revenue from existing customers and a credible probability-weighted pipeline, you still have a large gap to hit your forward revenue number, my recommendation is to haircut your projections. We will do it anyway, and you will build credibility by doing it for us.

Note: I would like to thank Dick Harrington, Tony Tjan, and Scott Sansovich for their valuable insights on this topic.

Copyright 2015 Ali Rahimtula. All rights reserved.

Very insightful

LikeLike

Thanks for this, it’s a really nice read. Do you think that if we gave our projections a hair-cut would a possible investor give it an additional hair-cut?

LikeLike

Hi Jason – that is an excellent question. My advice is that an astute investor will haircut your projections only if they are unreasonable. If your projected revenue is in line with your contracted revenue plus a credibly weighted pipeline then I would give you full credit for it.

LikeLike

Future pipeline matters — non-kitchen-sink. I like your categories: interest, consensus, evaluation, decision, and then close. Even after a customer has “decided,” it’s 70%!

LikeLike

Good stuff.

Honestly projections early on show more about your understanding of your market than any reality of creating the revenue.

If you are at a $500K run rate ramping to $1.5M let’s say, this is an exercise is market knowledge not something you can build a team on.

So–I’m a huge fan of modeling. Also a pragmatist to understand that this is an exercise more than a planning tool.

LikeLike

Our first attempt at seed funding last year – pitching in person went really well but when we submitted our realistic forecast for sales we were dropped like a hot potato for thinking too small. Overblown figures dominate the space and like inflated house prices everyone just ups their estimates and their ideas of what is achievable. I come from a traditional business building background and find all this irritating. Every few years these inflated ideas will plummet but in between, like trying to buy a house, it’s a pain.

LikeLike