Note: I would like to thank Cody Gaynor at Wilson Sonsini for his valuable insights on this topic. Any entrepreneur looking for a smart and numerate lawyer would do well to consider Cody.

One of the more interesting analytical exercises that comes up time and time again whenever a company that has raised institutional capital explores a sale is how the sale proceeds will be distributed to the various stakeholders. Depending on the what the returns look like for each party, it may influence whether a particular exit path is feasible or not. It is a good idea for all stakeholders (management, senior security investors, junior security investors, etc.) to have such a model handy when discussing strategic options.

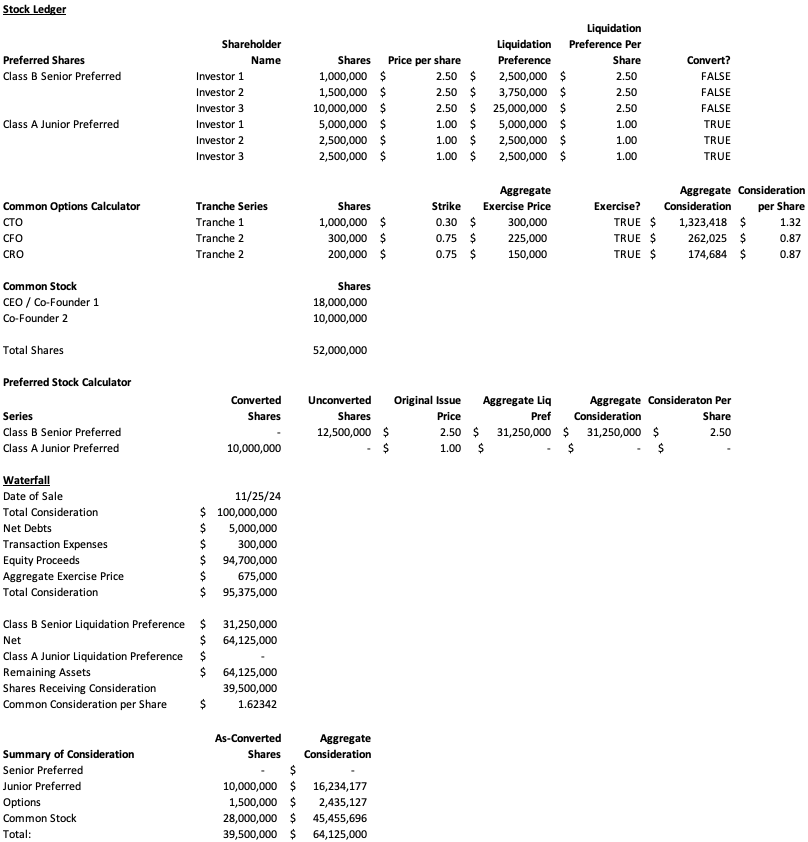

The key analytical complexity is as follows. Preferred shares have a liquidation preference, and the investors in such stock have the option to keep that liquidation preference and get paid directly from the sale proceeds or convert to common stock and get paid on an as-converted basis, depending on which outcome pays them more. Going down the capital stack in order of seniority, each conversion decision impacts the effective number of shares outstanding, as well as the net proceeds available to such shares.

What follows is an illustrative model, that, while very simple, includes the math on the conversion and exercise decisions as well as the proceeds waterfall calculation.

Some important points to note:

- In the Excel settings, iterative calculations (also called circular references) need to be enabled. This is because each conversion decision iteratively impacts the share price, which in turn impacts the conversion calculation (i.e. the higher the effective share price, the more likely the class of preferred shares is likely to convert).

- The key cell in the model is the “Common Consideration per Share.” This cell takes the net proceeds and divides it by the shares receiving consideration. This value is referenced in the “Convert?” column for the preferred shares as well as the “Exercise?” column for the stock options. Specifically, if the liquidation preference per share is lower than the common consideration per share, the preferred share class converts to common. With the options, if the strike price is less than the common consideration per share, the options are exercised.

- The “SUMIF” function is the most effective way to add up the various preferred share liquidation preference amounts and preferred shares that are converted. This function adds the value of the cell that is referenced only if a certain condition is met. For example, if the “Convert” cell is “TRUE,” add the shares, otherwise, add zero. Conversely, if the “Convert” cell is “FALSE,” add the liquidation preference amount to the waterfall, otherwise, add zero. Similarly, the “SUMIF” function is also used on the stock options to add up the shares that are exercised.

- In the preferred stock calculator, sometimes, when the stock does not convert, there are not enough proceeds to pay the full liquidation preference. In this case, the senior preference shares get paid before the subordinated preference shares. Additionally, if there are not enough proceeds to fully pay the liquidation preference in a particular share class, the proceeds are allocated pro rata between that class (as specified in the investment documents or the company’s latest Certificate of Incorporation).

- The treatment of the common share options is also interesting. Usually, the strike price is set at a discount to the preferred round price, and in the example above, all options tranches are exercised. Options are usually net exercised (meaning the strike price is effectively netted from the proceeds received by the options holder in a sale). Because the proceeds to the option holders are reduced by the amount of the aggregate exercise price, that extra amount is added to the consideration payable to the common (the “Aggregate Exercise Price” line in the waterfall).

- The Waterfall starts with the headline price, then takes out net debt and transaction expenses. From that number, proceeds paid to preferred shares that are paid their liquidation preference are deducted. The remaining proceeds after preferred payments is the numerator for the per share calculation.

- The denominator in the per share calculation includes all the preference shares that convert and all the common stock options that are exercised. It also includes all the common shares outstanding (usually founder shares). These shares have no conversion or exercise decision, i.e. they are outstanding no matter what the sale price.

At a high level, if the exit is a home run, all preferred share classes will convert and options tranches will exercise. In some cases, such as in the example above, one preferred class will convert but the other will not. In this case, the junior preferred shares have a lower liquidation preference per share than the common consideration per share, so it converts. On the other hand, the senior preferred shares have a higher liquidation preference per share, so they do not convert.

Occasionally, the waterfall exercise becomes more complicated where there are many (sometimes dozens) of shares classes. Additionally, sometimes the liquidation preference calculations are more sophisticated, as in when there is a liquidation preference greater than 1x, a liquidation preference accretion over time, or a participating preferred security. But even in these more advanced cases, the basic math is the same, and it is helpful to understand the high-level mechanics of the waterfall.

Just as important as understanding your economics is to understand what each other stake holder would be getting in a potential sale. This way, you can quickly and efficiently determine whether a particular exit scenario is worth pursuing, and be best positioned to negotiate an optimal outcome.