(Updated 11/26/2018)

By: Ali Rahimtula, Anthony Tjan, Dick Harrington

- Introduction

Few topics are of higher interest and concern amongst startup management teams than compensation. Surprisingly, however, there has been relatively little written on this subject.

In early stage startups and venture-backed companies, this issue has special significance because cash is scarce. Mistakes early on can doom a startup. As a company evolves, equity becomes more valuable and the design of a compensation scheme needs to become more scientific and thoughtfully planned.

Compensation Scheme Goals

A well-designed compensation plan can help attract and motivate employees. More specifically, a well-designed compensation plan can:

- Reward performance.

- Align management and shareholders, i.e. motivate management and employees to maximize shareholder value.

- Attract stronger management and better employees.

- Retain employees, especially the top performers.

- Foster longer-term thinking (“long-term greedy”[1] mindset).

- Foster a team-oriented culture, where employees across different functional groups will help each other for the good of the company overall.

- Allow for scalability as the company grows, i.e. having a fair and transparent compensation scheme that does not require managers to spend significant time justifying compensation levels to individual direct reports.

Scope

This piece will cover compensation design for CEO, top management, and employees (including technical employees). We will not cover salesperson compensation, however. Salesperson compensation is a different beast and best covered in a separate post.

Additionally, there are two broad buckets of compensation: (1) cash compensation (which can be further broken down into salary and cash bonus) and (2) equity compensation. Cash is a short-term incentive, whereas equity is a long-term incentive. A properly designed compensation plan requires an understanding of both the short-term and long-term levers.

First we will cover cash compensation. Then we will cover equity compensation (including new hire as well as retention or evergreen grants). Finally, before offering some concluding thoughts, we provide a library of best practices and common mistakes to avoid.

Acknowledgements

For this post we have co-opted three experts in the field – Sanjeev Dheer, Leslie Brunner, and Jason Kilpela. Sanjeev is the founder and CEO of CENTRL, previously the founder and CEO of CashEdge, and before that a partner at McKinsey & Co. Leslie is President of MiniLuxe and previously led operations and talent management for athenahealth, growing the team from eight people to 4,300. Jason is the VP of Finance and Business Development at Kapost. All three have had very valuable experience on this topic and we are grateful for their insights.

CENTRL, MiniLuxe, and Kapost are Cue Ball portfolio companies.

- Cash Compensation

Cash compensation is comprised of a base cash salary and a variable cash bonus.

Cash salary is a relatively straightforward concept. Variable compensation or cash bonuses, on the other hand, are more complex to properly implement. A cash bonus scheme requires a carefully constructed and board-approved financial and operating plan for the next year. When used properly, variable cash compensation is a powerful lever to drive behavior that can impact the following year’s results.

Setting Cash Base and Bonus Levels

Here, the task is to find the market rate for the position and location (i.e. San Francisco Bay Area, NYC, and Boston will be higher than other locations) and adjust it from there. Ideally, especially in the early stages, many CEOs try to pay slightly below market rates and try to make up for it on the equity side (i.e. convincing candidates that the equity will be valuable). We think this approach makes a lot of sense because it preserves cash. It is also a positive signal that the soon-to-be employee highly values the future potential value of the company.

Cash compensation is best considered holistically, i.e. in aggregate with equity compensation. In setting the cash compensation number, there is no standard answer and there is room for tailoring to board objectives and individual management or CEO goals. There is considerable flexibility for management to trade cash compensation if they want more upside via a greater equity grant. Certain CEOs may be cash rich from previous ventures or may simply prefer a higher risk-reward profile.

For example, I once heard a technology company CEO (who successfully sold his last company) say that his board-proposed cash bonus was not particularly effective because his target bonus number was less than the cost of the watch he was wearing (it was an expensive watch).

Thoughts on Metrics

There are numerous metrics to choose from, ranging from financial vs. operating metrics and quantitative vs. qualitative ones.

Some leading thinkers in this space – for example, Leslie Brunner – believe that paying on purely financial metrics is risky because you lose sight of the longer-term health of the company and culture. Additionally, there are leading indicators that deteriorate before financial metrics do, such as employee turnover or other non-financial metrics such as NPS score.

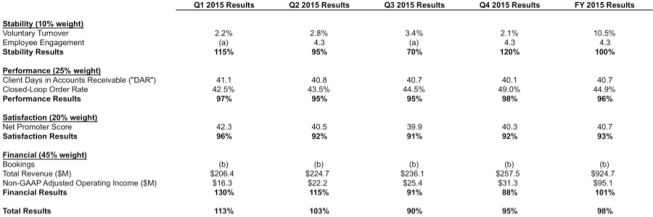

athenahealth compensates senior management based on eight metrics along what it calls Stability, Performance, Satisfaction, and Financial parameters, as shown below. This is a balanced, holistic approach that still provides a 45% weighting to financial metrics.

Generally, for earlier stage companies, it is simpler to use financial metrics or metrics that directly lead to financial performance and are easy to track (such as MRR growth or churn for a SaaS company). For all companies, we prefer quantitative metrics over qualitative ones, because they can be objectively measured and it is possible to manage to them.

Cash Bonus Example

Below is an example of how a cash compensation plan for a CEO might work. Note that the specific metrics used will differ by company.

There are three steps to determine cash bonus: (1) choose the most important metrics, as well as the respective goals and thresholds for each, (2) determine the relative weighting for each metric, and (3) determine how each one scales.

The CEO’s base salary is $125,000 and the target bonus is $125,000 as well.

The three most important metrics we want to optimize around are: (1) gross new MRR, (2) MRR renewal rate, and (3) burn-rate.

(1) Gross new MRR – 40% weighting

- FY 2017 goal = $500,000

- Threshold: If below 80% of this amount is reached, no bonus is paid.

- Bonus amount paid ratably between 80% and 100%.

- Accelerator: Bonus paid at 300% the rate above for amounts achieved over 100% of MRR goal.

Example: If a new MRR of $560,000 is reached, the bonus number for this metric would be:

$125,000 * 40% = $50,000 for reaching the goal, plus

$60,000/$500,000 * $50,000 * 300% = $18,000 for exceeding the target MRR

or $78,000 in total.

(2) MRR renewal rate – 30% weighting

- FY2017 goal: 92%

- Threshold: Having an MRR renewal above 88% is considered important for the long-term success of the business. Below this number, no bonus is paid for this factor.

- Bonus scales ratably between 88% and 92% to target bonus.

- Accelerator: Achieving a retention rate of 100% will earn a bonus of 300% of target. Bonus scales ratably between 92% and 100% retention to this number.

The payout for this metric would look like this:

(3) Burn-rate – 30% weighting

- Target $100k/month average net burn for the year.

- If actual burn rate exceeds this amount by 10%, no bonus is paid for this metric.

- Positive and negative accelerators can be used here but for the sake of simplicity we’ll make this a cliff metric that is either hit or not.

Putting it all together:

If the FY 2017 results were:

- Gross new MRR = $560,000

- MRR renewal rate = 90%

- Net Burn = $105,000

Cash Bonus = $78,000 + $22,500 + ($125,000 * 30%) = $138,000

For later stage companies, it is often more appropriate to use simpler financial metrics such as revenue, EBITDA, or free cash flow. For example, it could be a 60% weighting on revenue and 40% on an EBITDA target, with an extra 20% or negative 20% based on a free cash flow target.

Occasionally, certain management members may assert that the fairer way to determine compensation is to look at what percentage of the “target number” was reached. We disagree with this approach. Why should a bonus be paid for “achieving” last year’s number? At a minimum, the revenue threshold should start at last year’s number.

For example, if the revenue target is 50% growth over the previous year or $5,000,000, and the company achieves a $4,000,000, they may argue that 80% of the target is achieved. We don’t agree with this. We think it makes more sense to be paid ratably between a threshold (say 80 or 90%) and 100%, and provide a kicker if the revenue target is exceeded. For example, if revenue of only $2,500,000 was achieved, it would make no sense to earn 50% of the bonus for this metric – it should probably be zero.

The range of bonus payment relative to base salary can be wide, going from zero to as high as 200% of base (often depending on CEO preference, i.e. someone may prefer a lower base in exchange for a higher potential total cash package). In practice, the cash bonus payment as a percentage of target typically ranges from 90% to 120%, with 100% being the target if the base plan is achieved (although the range of possible outcomes is much wider). Remember, the base case board plan is intended to be what the team believes can be achieved, not pie in the sky.

Another design principle is to only incorporate metrics that the individual has some direct ability to impact. So for example, short-term balance sheet metrics (i.e. working capital management) are only applicable to the CEO and CFO.

Importance of Performance Review[2]

A critical component of the variable compensation process is the performance review. A properly executed performance review that has depth and thoughtfulness requires significant time and preparation on the part of the reviewer. The review, and the variable compensation itself, should be objectively determined by looking at performance relative to plan (as explained above). In addition to explaining the logic for the compensation level and providing a sense of transparency and fairness, a properly executed review will allow the opportunity for the employee to improve future performance. Here are some performance review best practices:

- Andy Grove has a useful best practice, which is to give the written review to the employee shortly before face-to-face review. If they get it during the review, they are too distracted reading it to pay attention to the discussion. If they get it after, they will not have enough time to think about and digest the feedback.

- Provide specific, actionable feedback.

- Be balanced and don’t shy away from negative feedback.

- Objectively assess actual performance output relative to plan.

- Assess the individual as well as, if applicable, the organization they manage.

- Concentrate on 2-3 key messages.

- For under-performers, to the extent you want them to remain with the organization, reinforce to them that this process resets every year so everybody has a chance to be successful in the coming year.

- If allowing for 360-degree feedback (i.e. subordinate feedback on their supervisor), separate this session from the subordinate’s compensation discussion (do it at a different time).

- Discourage anonymous feedback. Generally, this is a total waste of time as people try to guess the source. Encourage people to talk about their grievances face-to-face and try to resolve it in real-time.

- Spend significant effort providing advice for improvement for strong performers. Typically we tend to concentrate our efforts to improve underperformers but given their disproportionate impact on the organization, just as much, if not more effort should be spent on the top performers.

- Equity Compensation

Equity compensation takes the form of employee stock options or restricted stock units (RSUs). Employee stock options work well for early stage private companies, whereas RSUs are more common in later stage (think $1 billion valuation and up) as well as public companies.

Typically, these vest over four years. Investors prefer double-trigger acceleration which means that the management team member and employee unvested options will fully vest if both of the following occur: (1) sale of company and (2) involuntary termination of employee. Investors don’t like single-acceleration (specifically triggered upon a sale) given that this makes the company less valuable to a potential acquirer.

Early stage technology companies need to make it for stock options to be worth something. This category of compensation is critical to attracting and retaining key employees and also helps long-term alignment of management with other equity owners.

New Hire Grants[3]

For equity compensation, Fred Wilson has an excellent framework for startups that can help determine the amount of equity to grant.

The framework is not applicable to co-founders or new CEO or COOs that are non-founder hires. For these hires, the equity allocation amount is a one-off negotiation typically based on ownership points (percentage) of the company. But after the core team is in place, the framework works well and helps migrate the equity allocation process from a percentage mindset to more of a dollar value mindset. In so doing, it has the dual benefit of being less dilutive to founders and also normalizes for different company values. This latter point is important. If a founding CEO has a “points” mindset (i.e. market rate for an engineer is 0.5% of the company, for example) this does not take into account the value of the company. Half a percentage point is more valuable for a company worth $100mm than one worth $10mm.

Multipliers:

- Senior management (CFO, CRO, VP Sales, CMO, CTO etc.): 0.5x

- Director level (including key engineers): 0.25x

- Employees in key functions (engineering, product, marketing, etc.): 0.1x

- Other employees: 0.05x

The amount of equity to grant follows this formula:

Shares granted = (Base salary * Multiplier) / (Most recent market valuation for company equity / fully diluted shares)

So, for example, for a CMO with a market rate base salary of $150,000, a post-money valuation on a recent financing round of $40,000,000, and 20,000,000 fully diluted shares outstanding, the number of options granted would be:

($150,000 * 0.5x) / ($40,000,000 / 20,000,000)

=$75,000 / $2.00

= 37,500

If the company performs according to plan, we would expect the value of the grant to be several-fold more valuable than $75,000.

Evergreen Grants – Increasing Retention[4]

One of the most important features of equity compensation is that it is a means to improve retention of top-performing employees. Obviously, the most significant factor in retention is the trajectory of the company. A rocket ship will have more success retaining top employees than a company that is struggling. But normalizing for this, a properly structured grant scheme around retention, strong performance, and promotion can decrease turnover significantly.

The problem of retention – where the average tenure of an engineer at a US-based venture-backed company is about two years – has become more acute of late, because length of time to achieve an exit (either via M&A or IPO) is increasing. As the data below[5] shows, the median time from founding to exit has increased by 2 years or 50% from 2000 to 2015.

The best framework I have seen for ongoing or evergreen retention grants is from Andy Rachleff, the founder of Wealthfront (also called the Wealthfront scheme).

Rachleff notes that there are four cases upon which new equity grants should be provided:

- New Hires – this is described above in the previous section.

- Promotions – the size of the grant here will bridge the difference between the size of grant for a new hire at this position at the market rate and what they have been granted.

- Outstanding Performance – these are annual grants for non-management Typically these would be awarded to the top 10 to 20% of the employee base and would be in an amount equal to 50% of the grant size were they hired as a new employee today.

- Evergreen – Applicable for all employees, these should start 2 to 2.5 years from the employee’s start date, and then continue each subsequent year. Each annual evergreen grant should equal 25% of the four-year market grant they would get if hired today at this level.

For 2-4, the grant vesting is spread out over four years (same as the new hire grant), however there is no need to do cliff in the first year (vesting can be monthly or quarterly from the grant date).

The critical insight here with #4 – the evergreen grant – is to provide the grant at 2 – 2.5 years into the original four year vesting cycle. This allows employees to always have a significant amount of unvested equity. The benefit is to effectively nip the urge to look around for new job opportunities in the bud. We encourage companies to be transparent about their evergreen equity grant program so that employees build this into their compensation expectations and mindset.

The dilution with this scheme is about 3.5 – 5% per year (not counting additional new executive hiring). This is on average about 75bps more dilutive per year than a more conservative scheme that does not use this model. This incremental dilution is, we believe, dramatically outweighed by the benefit of better retention of top performing employees.

For numbers 2-4, the size of the grant can be determined using the methodology of the previous section.

A Note on Vesting

The typical vesting schedule in the Valley today is over four years, with a one-year cliff and quarterly or monthly vesting thereafter.

More recently, some of our portfolio companies have experimented with longer (i.e. 5-years vs. 4-years) and more back-end weighted vesting schedules to align employees over the longer-term.

It is not just startups. Amazon, for instance, has a back-ended vesting schedule of 5%, 15%, 40%, and 40%.

At Cue Ball, we recommend our portfolio companies to implement a 5-year vesting schedule as follows: 10%, 15%, 20%, 25%, and 30%.

Most of our founder/CEOs like this default schedule, so long as they have the ability to fall back to the more common 4-year ratable vesting schedule in especially competitive recruiting situations.

- Library of Compensation Best Practices

Plan Upfront (It Will Pay Off Later)

A clear philosophy and a significant amount of planning are required to design an effective startup compensation scheme.

You need to consider the team required to successfully pursue the opportunity. You need to also consider the composition and organization of the team across function (product, engineering, sales/marketing, customer service support, finance, etc.) and across different levels of management that you feel is required. This is important because you have finite bucket of cash and stock to apportion and you have to think hard about which people are right for the company.

With respect to this planning process, we suggest starting with the senior leadership team you want on board first. Additionally, for the senior management team we have seen it be effective to pay the same base cash compensation but allocate different option levels (based on importance to the company and when they come on board).

The table below is an example of a budgeting exercise for options. At the bottom you can see how much of the current option pool is unallocated – a key metric to keep in mind during the planning process.

Look at Compensation in Aggregate

When evaluating any particular component of compensation (i.e. cash bonus levels or equity grant amounts for the next year), it is useful to look at all components of compensation in aggregate. It is difficult to opine on a cash bonus, for example, without knowing the amount and value of equity they have been granted. An example from one of our portfolio that provides a good composite view (numbers altered) is below.

Be Unapologetic about Variable Compensation and Compensation Tied to Company Performance

Our recruiting philosophy for early stage companies is that candidates have to buy into the true essence of what you are doing – and that includes the risk-reward proposition.

This implies middle of the road or slightly below-market base cash compensation and a fair amount of upside via options allocations if you do well. If the potential hire is not comfortable with this, they are not aligned with what you are trying to accomplish.

We are big fans of rewarding people on variable compensation (bonus and equity) at VC-backed companies. It sends the right message to the right candidates that a dynamic technology startup wants to attract.

Be unapologetic about it. There is risk involved. If they don’t want to be risk takers then they are probably not right for this stage of company.

Tie Variable Compensation to the Board Plan

The implementation of a variable compensation scheme often provides the opportunity to create a thoughtful and reasonable financial plan (not low ball, not pie in sky) for the coming year. One of the most significant benefits of a variable compensation scheme is that it provides a lever to incent management to adhere to it. This means not paying your management team by default if all of a sudden the business is going sideways. Additionally, this is important because you don’t want to have several miscellaneous plans – rather you want one plan with everyone rolling in the same direction.

The short-term (usually annual) plan has to be aligned with the budgeted operating and financial goals that the management team has to accomplish this year. It should include the most important criteria you want to hit, and may cover, for example, revenue growth, operating income, cash flow, or other financial or operating metrics (see above).

Timeliness of the board plan is important here. We consider it best practice to approve the board plan in January (assuming the company has a calendar year). It is not uncommon for some startups to wait until later in the year to get their board plan approved. When this happens, it may be the case that the board plan is no longer relevant for the year, either because it is clear at that point that the company will not achieve its numbers or the reverse. More importantly, it makes it difficult for the management team to work towards achieving these goals if it is not clearly decided and communicated at the beginning of the year. One argument sometimes made to justify a delay in the adoption of the board plan is that the previous year has not yet been formally closed. In this case we recommend using the provisional financials from the past year from which to build the plan (they should not change much and presumably 10/12 or 11/12 of the year’s financials will have been scrubbed so there is not that much uncertainty).

Simple is Better

We would recommend making the short-term plan as simple as possible – too many individual activities create a dynamic that is too complicated and hard to manage. Everybody should understand the drivers. For example, a 20-point short-term plan with a 5% weighting on each is hard to measure and more importantly hard for your management team to focus on.

Quantitative Metrics are Better than Qualitative Ones

When it comes to the specific metrics upon which to determine the level of discretionary compensation, we prefer quantitative metrics over qualitative ones. Quantitative metrics are objective and clearer to monitor as a benchmark for management teams to accomplish. Remember, the board always has the ability to grant additional bonus if some qualitative metric is achieved.

Be Transparent

While confidentiality around compensation in theory has certain benefits, the reality is that you have to assume that employees talk and exchange compensation details.

Transparency and consistency in setting compensation levels create several benefits:

- It creates clarity that promotes an environment of fairness that helps employees feel secure. It avoids misunderstanding relative to what someone signed up for. It eases feelings of insecurity.

- It obviates the need for many CEO conversations with employees. It saves a lot of time and therefore allows for scalability as the organization grows.

- Transparency fosters an atmosphere of togetherness. We all know the budget and we all know the plan we have to accomplish together.

When athenahealth, a pioneer in this area, experimented with compensation transparency, they published compensation ranges (including cash bonus level) for every position at the company. They were consistent all the way down from CEO to front line employees. They found it to be powerful for employees and also it helped them scale.

- Biggest Compensation Mistakes to Avoid

Too desperate to hire a certain employee and using salary to attract them. A recruiter for a startup needs to be really good at selling the dream. Companies need to believe in what they have. Not everybody buys the dream and that’s ok. Don’t immediately fall to comp as the answer. Startup life can be terrifying at times and the people you hire need to have grit and heart and understand the long-term potential of the business.

Having a plan that is 100% weighted on operating income. For later stage companies this is a mistake because it is possible to achieve this largely by cutting costs (even if you fail to grow revenue). In this case, the company can lose momentum on driving growth. In general, it is better to have a more balanced operating plan (such as to include both top-line growth and operating income or cash burn) to award variable compensation.

Burning too much cash on compensation early on. If an early stage company overpays with stock, you can recover from that. Burning too much cash, on the other hand, can sometimes be fatal for early stage startups.

Over-hiring junior employees. A trap that startups sometimes fall into is to hire low paid junior employees because each will cost you less than hiring the right skilled person. A lot of busy-work can be done at startups if this happens. Compensation per employee may be low but you do not get productivity. We have seen this sometimes manifested with overseas development offices.

Being too stingy with compensation. For certain key employees, there is a cash compensation level below which it is a strain for the employee to make it work. While they may want to join the company, coming on board below that threshold is a recipe for failure. Often it is an employee with a young family in a geography with a high cost of living. In the compensation negotiation they are usually focused on an absolute compensation level versus a relative one. In these cases, there simply is not much room to cut below market rates. If you do, you won’t get them (larger companies will pay and get them). You don’t need to hire a lot of people. Be very clear on the number you require and if need be, pay close to market rates to get the right people.

Falling into trap of title inflation. Titles are free. Why not give out inflated titles if it saves cash and/or equity?

We don’t agree with this approach.

First, as a practical matter, with title inflation, you will eventually run out of grades. If I’m a SVP – what do I do next? EVP? At a startup, this level of complexity is silly and confusing.

More importantly, it distracts employees from focusing on the company as a whole. People will ask why you promoted someone when their job is not changing. It creates unnecessary stress, and it introduces politics into the day-to-day discourse.

A flatter organization at a startup is more amenable to creating a culture focused on deliverables.

Not fairly rewarding contributions for a sales win. In a small company, many team members help to win a deal. Problems often arise when everybody knows that a salesperson got a ton of money but the broader team instrumental in the sale got nothing. The problem is compounded when the next deal comes around – and this team is less inclined to help. This problem can be alleviated by specifically recognizing and rewarding non-salesperson contributions to the sales process.

Not properly explaining how the equity compensation works, especially for employees joining from more institutional settings. Often, when startups hire people from large companies and they take a cash compensation cut in exchange for a larger potential equity gain, they don’t truly understand the risk they are taking. They can often be uneducated about the mechanics and potential value of equity compensation in a base case outcome. An accurate and transparent understanding can prevent an ugly situation in the future.

- Closing Thoughts

How Structure Evolves with Company Stage in Lifecycle

While certain best practices are constant throughout any company stage, we have noticed that certain changes of approach are appropriate as a company matures.

The composition of employees that get equity changes. One question that we often get asked is if everyone at the company should get equity. In the earlier days when the team is small and there is considerable risk, it is ok to offer equity to every employee. Partly, this is due to the fact that cash is scarce but also it can be good from a cultural perspective to give every employee some degree of ownership. As a company matures, however, equity should generally be limited to those that can have an impact on the company trajectory or position in the marketplace. For example, every software engineer should get equity because of their importance (and also their demand in the marketplace) but a receptionist may not.

From cash scarcity to equity scarcity. At the pre- and early-revenue stage, cash is scarce. At this point, companies generally attempt to manage cash burn and it is appropriate to try to pay less total cash compensation and be more generous on the equity side. As a company matures, generates revenue and raises larger funding rounds, dilution becomes more of an issue and the company can afford to pay higher or even market cash salaries and bonuses but the equity grants will be smaller.

Escape “percentage” syndrome. For most companies, it will make sense to move from a “points” to a “dollar” mentality for most employee hires. In the early days of a company – the first few hires such as technical co-founder or for major hires such as a CEO or COO, it is appropriate to think about equity grants on a percentage or points basis. As we alluded to above, however, once the core team is in place it is appropriate and less dilutive to think about equity grants in terms of dollar value.

A well-constructed cash and equity compensation plan takes a lot of thought but pays significant dividends and will help your company be more successful. We hope this piece helps you design the right plan for your startup.

End Notes:

[1] Term coined by Goldman Sachs’ Gustave Levy.

[2] A number of ideas in the review section come from Andy Grove’s book “High Output Management.”

[3] The framework for new hire equity grants is based on work by Fred Wilson.

[4] Retention grant framework based on work by Andy Rachleff.

[5] From Pitchbook.

Epic post! Thanks, Ali.

LikeLike

One of the best posts I’ve ever read re: start up comp. Thanks!!

LikeLike